Remote identity verification remains a concern for banks as it often constitutes the first contact with their clients. Therefore, addressing these processes with guarantees is a challenge. On the one hand, clients want systems that are usable and fast, while safeguarding their privacy. On the other, institutions need to ensure that their clients are who they say they are to avoid fraud. Finally, some regulations require compliance with minimum standards for these remote verification processes.

In this context, the EBA (European Banking Authority) has recently issued new guidelines to unify how the remote onboarding processes of clients in the financial industry within the European Union should be, while the European Commission has reached an agreement to promote the new European digital identity (eID), which will allow citizens to open online bank accounts with an electronic wallet (not before 3 years).

Many questions, along with technological (and in many cases regulatory) advances, can be daunting for technology or compliance managers in the banking sector.

Finding the balance between digital security and customer convenience is paramount, and here, biometric technologies in the financial industry have become the spearhead of customer digital verification and economic innovation. From account opening to transaction authentication, financial institutions are adopting biometrics to provide more secure and efficient services.

But how are biometric technologies being applied in the financial industry, and how will they evolve within this constantly changing environment?

Facial Recognition: The new face of banking

It is precisely in the search for that balance, at the intersection between security and innovation, that facial recognition has emerged in recent years as a key tool in modern banking. This technological advance is not merely a convenience; it is a revolution that redefines the way banks interact with their clients.

The figures speak for themselves. According to a report from Allied Market Research, the global facial recognition market (valued at USD 5.150 billion in 2022) is expected to grow at a compound annual growth rate (CAGR) of 16.4% from 2023 to 2032, reaching USD 24.300 billion. Other studies, like that of Grand View Research, date that growth at a significant 14.9%. Either way, we can agree that it is a very high growth rate. This expansion is driven by the need for more robust identification systems and biometric technologies in the financial industry and the growing demand for mobile banking and online services.

Facial recognition is more than an additional layer of security; it is a way to get to know the customer without the need for physical interaction. At Mobbeel, we have integrated this technology into the opening of online bank accounts. Our digital onboarding solution, Mobbscan, ensures that the process is 100% automatic, allowing clients to open an account anywhere, at any time, with the guarantee that their identity is protected.

Beyond account opening with biometrics

But the implementation goes beyond account opening. In day-to-day life, face recognition allows clients to access their mobile banking apps, authorize payments, or withdraw money at ATMs with just a glance. This immediacy and ease of use are transforming customer expectations and raising the standard of what constitutes exceptional service.

However, with great power comes great responsibility. The implementation of facial biometrics brings with it concerns about privacy and ethics. Banks and technology providers must work within a strict regulatory framework, ensuring that biometric data is handled with the highest level of security and only for the intended purposes. The General Data Protection Regulation (GDPR) in the European Union, for example, sets clear guidelines on how biometric data must be collected and processed.

Our technology is designed not only to comply but to exceed security and privacy expectations. Each facial interaction is an opportunity to reinforce customer trust, demonstrating that their identity and assets are in safe hands.

There are weighty reasons why facial recognition is destined to become a pillar of biometric technologies in the financial industry. It is no longer a question of whether banks will adopt this technology but when and how. Those who move quickly to integrate facial biometrics will position themselves at the forefront of digital banking, offering not only enhanced security but also a user experience that is literally recognizable at first sight.

Delving deeper into the use of biometric technologies in financial industry payments

Biometric payments represent an innovation in point-of-sale technology based on biometric authentication. This technology allows funds to be deducted from a bank account using unique personal characteristics.

Biometric technology has been gaining recognition for some time now, especially in scenarios such as supermarkets, petrol stations and retail in general, making transactions easier and faster. In addition, retailers with online shops are starting to adopt biometrics for one-click payment processes. On the other hand, banks have also started a race to implement biometric verification to protect high-risk transactions, such as transfers or payment authorisations.

In the area of digital payments, consumers can now use biometric authentication, such as facial biometrics, to authorise online purchases securely. This form of authentication streamlines the payment process and adds a layer of security, mitigating the risk of fraud in digital transactions.

This trend has led to consumers primarily using mobile devices for their interactions with financial services. This transition has seen phones take a central role in everyday banking activities, including standard tasks such as accessing accounts, making transfers and managing online payments.

Voice biometrics in customer service: the voice you can trust

The voice is unique.

Or at least that is what we probably think every time we listen to Morgan Freeman or our favorite radio announcer. More than a simple means of communication, it is an auditory fingerprint, a personal distinctive that financial institutions are using to add an unprecedented layer of security and personalization in customer service.

Voice biometrics is consolidating itself as an authentication system that provides comfort and efficiency. It represents a significant advancement over traditional methods based on passwords and personal data or those used in most call centers, where the agent answering the call has to spend precious time asking questions to the person calling to verify their identity.

A frictionless user experience

The innovation in this area is palpable in the case of the insurer Santalucía, as in 2018, they were pioneers in Spain adopting our voice biometrics authentication technology to allow their clients to identify themselves when calling their call center for any incident. The success of the project lies in its ability to offer a frictionless user experience. With a simple registered phrase, clients are authenticated quickly and safely, which represents a significant improvement both in customer experience and operational efficiency. This system not only reduces the agent’s workload by eliminating the need to authenticate the client manually but also reduces the risk of fraud and identity theft.

Santalucía’s clients can now expect faster and more personalized attention, which reinforces loyalty and trust in the brand. “At Santalucía, my voice is my password!” is more than a slogan; it is a testimony to the company’s commitment to security and innovation.

The new standard for voice biometrics in bank-customer interaction

The technology behind voice biometrics is complex, as, like facial recognition technology, it is based on artificial intelligence. But its application is surprisingly simple. Through advanced algorithms and machine learning, the system analyzes hundreds of unique characteristics in the user’s voice to verify their identity. This not only makes it extremely difficult for an impostor to duplicate or falsify these features but also allows for almost instantaneous identification. Additionally, the technology is prepared to detect attacks of fraudulently generated voices by artificial intelligence such as voice deepfakes.

However, beyond comfort and security, voice biometrics has the potential to reduce the costs associated with customer service significantly. By reducing the average call handling time and improving the accuracy of authentication, banks and fintechs can offer better service while optimizing their resources. Basically, a win-win for both parties.

Mobbeel’s focus on integrating voice biometrics into the financial sector is clear: to provide solutions that not only improve security but also enhance the customer experience. With increasing adoption in the industry, voice biometrics is setting a new standard for bank-client interaction. It is a clear example of how technology can be used to build stronger and safer relationships between financial institutions and their clients.

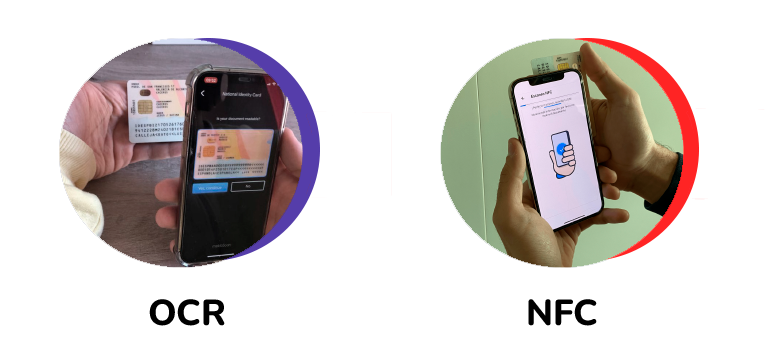

OCR and NFC: optimizing ID documents validation

Contact to us if you want to learn more about our biometric solutions tailored to the financial sector. We’re here to help you lead the change towards a promising future.

I’m a Software Engineer with a passion for Marketing, Communication, and helping companies expand internationally—areas I’m currently focused on as CMO at Mobbeel. I’m a mix of many things, some good, some not so much… perfectly imperfect.

INDUSTRY PAGE

Discover everything we can do for the financial sector

Identity verification is key for modernising banking processes, adhering to current regulations, and meeting the needs of digital customers and new generations.