“The Business Case for Biometric Authentication” (Goode Intelligence) emerged in 2018 as a comprehensive research assessing biometric authentication’s benefits in key sectors such as banking, financial services and other industries.

This study, based on primary sources and surveys of business leaders, shed light on the quantitative and qualitative benefits of biometric authentication. What it revealed at the time was impressive, and today, its findings are more relevant than ever.

As we progress through this article, we will explore not only the benefits of biometric authentication highlighted by the Goode Intelligence research but also the latest developments and other advantages that make biometric authentication an essential investment in the security and efficiency of user authentication across multiple platforms.

Goode Intelligence study conclusions and how they relate to the current biometric authentication market

The study’s conclusions could not be more revealing, coinciding with what we have been observing for some time through the results shown to us by our partners and customers.

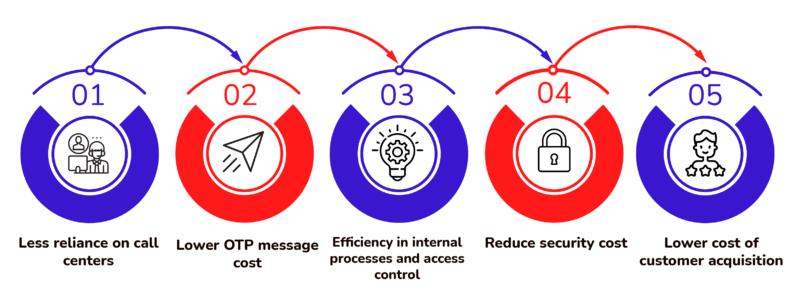

Thus, we can establish the benefits of biometric authentication as follows:

Cost reduction

Implementing an innovative but mature technology, such as biometric multi-factor user recognition, in the different phases of the relationship with the company generates massive savings in the company’s running costs. These savings can substantially impact the profitability and efficiency of the business model. Below are the main ones:

- Less reliance on call centres

One of the biggest running costs linked with traditional authentication is in call centres. Account recovery and password reset requests represent a significant load on call centres.

Biometric authentication drastically reduces the average call time, as users can authenticate securely and efficiently using their biometric features, such as voice biometrics or facial recognition.

The Goode Intelligence study backs up this fact by revealing that 56% of survey respondents noticed a reduction in the volume of calls to their call centre following the deployment of biometrics, estimated to save USD 6.25 million per year, calculated for a bank with 5 million customers.

This cost reduction has a positive financial impact and improves the customer experience by reducing wait times and frustration associated with support calls. The insurance company Santalucía is a witness to this.

- Lower OTP message costs

Traditional authentication often involves using text messages, also known as OTP or One Time Password, to verify the identity of users. These messages, while effective, have a cost. Biometric authentication eliminates the need for these codes, as users are authenticated by their unique biometric features. Another benefit of biometric authentication is the authentication process simplification.

- Efficiency in internal processes and access control

Adopting biometric authentication can also increase the efficiency of an organisation’s internal processes. Biometric systems can be integrated into a wide range of applications and systems, from building access to time record management. By simplifying authentication, waiting times and delays are reduced, improving employee productivity and diminishing running costs related to access control.

- Reduced security costs

While the initial implementation of biometrics may require significant investment due to integration costs, this technology, with the proper long-term support, can help reduce security-related costs. Biometrics is highly effective in preventing unauthorised access, which decreases the likelihood of costly security incidents such as data loss or sensitive information theft.

Lower cost of customer acquisition

The company achieves more efficient acquisition by implementing advanced customer acquisition practices, such as digital onboarding, a paperless digital signature process, and using OCR to auto-fill forms. It significantly reduces the costs associated with this process. Automating these tasks also minimises the expense of manually handling documents and records.

User loyalty and improved engagement

Biometric authentication is not only about cost savings but also impacts the relationship between a company and its customers. One of the most notable ways this occurs is through improved user engagement. Biometric authentication can boost the user experience to new levels, increasing loyalty and a stronger relationship between both parties.

To measure this engagement, many companies use a metric known as the Net Promoter Score (NPS), a measure of customer loyalty and willingness to recommend a company to others. It is based on a simple question: “How likely would you recommend this company to a friend or colleague?” Customers rate their answers on a scale from 0 to 10.

Customers are divided into three categories according to their answers:

- Promoters (9-10): highly loyal and willing to actively recommend.

- Passives (7-8): satisfied but not enthusiastic customers who may change their minds.

- Detractors (0-6): dissatisfied users who may speak negatively about the company.

NPS is calculated by subtracting the percentage of detractors from the percentage of promoters, resulting in a score that can be positive, negative or neutral. A high score indicates a high level of customer engagement and satisfaction.

Biometric authentication can contribute to a considerable increase in this score by using the user’s biometric features. The user feels more secure knowing their identity is protected and not relying on something they know.

Furthermore, NPS and biometric authentication also effectively align with neuromarketing by creating a pleasant and frictionless user experience. When users feel comfortable interacting with the company, their positive emotional answers translate into improved loyalty and positive recommendations.

Strong multichannel user experience

More and more companies opt for a single authentication platform that supports all channels. It contributes to operational efficiency and brings substantial cost savings by eliminating the need to maintain multiple authentication systems.

This measure also has positive aspects for users, as not having to remember and reset passwords saves time.

Furthermore, the adoption of this measure transforms user interaction, allowing users to interact with the company in the way that is most convenient for them. It directly impacts brand perception and demonstrates a tangible commitment to customer convenience, which can affect the choice of that brand’s products and services over those of competitors.

Security-related benefits

Biometric authentication stands as a vital pillar in protecting digital security. Its main virtue lies in the uniqueness and non-transferability of biological characteristics. Each facial scan or voice recognition is unique, giving this method exceptional protection.

The biometric approach effectively dissipates the vulnerability of forgotten, stolen or hacked passwords. Biometric authentication reduces exposure to the risks of unauthorised access and identity theft.

Algorithm support and data control

Biometric technology is also supported by highly accurate algorithms and advanced verification systems. These mechanisms prevent the falsification or manipulation of biometric data, providing a high level of confidence in user identification that is crucial in environments where security is a priority.

In the banking industry, biometric authentication has proven to be an essential tool against fraud protection. Sensitive transactions, such as transactions or payment authorisations, benefit considerably from biometric confirmation, ensuring that only legitimate account holders have access.

Undoubtedly, biometric authentication gives organisations more control over their data. This technology provides more visibility into who is accessing information and at what times. This functionality becomes a protection against unauthorised access, assuring organisations that their data is protected.

But are there risks related to biometric authentication?

Biometric systems are quite accurate but not infallible. Therefore, biometrics are not exempt from certain risks related to false positives, false negatives and identity theft.

- False positives are events in which the system incorrectly identifies a user as the legitimate holder of an account. It can occur when the technology misinterprets a person’s biometric features as a match to biometric data. Some examples of false positives can arise when there are facial similarities between two people (twins), data capture varies due to factors such as lighting, or when there is noise or distortion in the data.

- False negatives occur when the system does not correctly recognise the legitimate account holder and denies access to an authorised user. Biometric sensor calibration issues can cause false negatives, environmental factors such as insufficient lighting or background noise, and, in isolated cases, drastic changes in biometric characteristics due to physical injury or ageing.

- Identity theft is fraud when an impostor attempts to deceive the biometric system by presenting falsified or manipulated features. It can be achieved through various techniques, such as deepfakes.

Incorporating additional verification techniques, such as liveness detection, helps mitigate false positives, negatives, and identity theft.

Regulatory compliance

In the financial services industry, verification of customer identity is essential to prevent illicit activities such as money laundering. Biometric authentication provides a high level of certainty by validating customer identity through unique features such as facial recognition. This method meets the regulatory requirements of KYC and SEPBLAC regulations and integrates easily with AML processes.

Know the differences between KYC and AML

But biometrics not only plays an important role in verifying the identity of customers in the banking industry but also in other sectors such as online gambling. In gaming, it is necessary to verify the identity of players on withdrawals and age to prevent access by minors.

It can also be applied in other scenarios, such as border control, identification processes in public administrations such as passport issuance, and educational environments to ensure compliance with attendance and assessment policies.

Sustainability and ecology: meeting Agenda 2030 plan

Biometric authentication is an ally of sustainability, offering benefits that align with the Sustainable Development Goals (SDGs) of the 2030 Agenda.

Biometrics does not require physical cards and thus reduces the consumption of forest resources for producing paper and plastics. This small gesture supports Goal 12 on responsible consumption and production and Goal 13 on climate action by reducing the ecological footprint and waste generated.

Energy efficiency, a cornerstone in the fight against climate change, is also reflected in biometric authentication. By its nature, this technology consumes less energy than other traditional methods. Thus, it contributes to Goal 7, affordable and clean energy, by promoting a more efficient use of energy resources.

Additionally, biometric authentication reduces the need for physical travel and minimises carbon emissions by allowing transactions and identity verification to be carried out remotely.

Another advantage of biometric authentication is that it enables access to essential services from any location, promoting digital inclusion and opening up opportunities in rural areas such as depopulated Spain (España vaciada). This accessibility, linked to Goal 9 and Goal 10 on reducing inequalities, enables equitable access to essential services such as healthcare.

Biometric authentication: solutions to key user authentication problems

As we have seen, the benefits of biometric authentication are various for both users and enterprises, whether it is improving the user experience, increasing enterprise security, reducing fraudulent use or complying with regulations.

Nevertheless, which solution offers solutions to the main problems of user authentication? MobbID, Mobbeel’s innovative multibiometric solution, is a technology that addresses the most pressing biometric authentication challenges.

Usability

Security

Compliance

Our solution fuses cutting-edge biometric technologies to provide an exceptional authentication experience, overcoming traditional security and efficiency limitations. By enabling multiple biometric features, such as facial and voice recognition, MobbID releases a new standard in identity verification, ensuring secure, fast and reliable access to digital platforms.

Please get in touch with us if you want to know what we can do for your company. We have been providing multi-biometric recognition solutions for mobile devices since 2009. If big companies have trusted us, why not you?

I am a Computer Engineer who loves Marketing, Communication and companies’ internationalization, tasks I’m developing as CMO at Mobbeel. I am loads of things, some good, many bad… I’m perfectly imperfect.

GUIDE

Identify your users through their face

In this analogue-digital duality, one of the processes that remains essential for ensuring security is identity verification through facial recognition. The face, being the mirror of the soul, provides a unique defence against fraud, adding reliability to the identification process.